“Never, ever, think about something else when you should be thinking about the power of incentives.” – Charlie Munger

The Owner-Operator Advantage and Our Portfolio Focus

- Breach Inlet Capital prioritizes long-term returns for our Partners

- We favor “owner-operator” businesses where the CEO and/or Chairperson owns significant equity and is often the founder

- Insiders’ large ownership stakes sharpen focus on value creation and increase alignment with us as minority shareholders

- We consider aligned operators tend to be less myopic, as they prioritize long-term growth vs. beating Wall Street’s quarterly estimates

- Owner/operators think independently and avoid the herd mentality of peers

- We believe the owner-operator approach has a positive impact on company fundamentals and thus equity values over the long-term

Owner-Operator Mentality Leads to Better Capital Allocation

We believe owner-operators spend excess cash like it’s their own, because it truly is. Value maximizing capital allocation decisions include, but are not limited to:

- Repurchasing shares

- Special dividends

- Value-accretive M&A

- Strategic usage of debt

- Internal investments

Our Portfolio Companies with Owner/Operators

- IES Holdings (IESC)

- Leading installer of integrated electrical systems in data centers, e-commerce warehouses, high-tech manufacturing facilities, and residential homes

- Intermex (IMXI)

- Leading provider of money transfer services from the U.S. to Latin America

- OneWater Marine (ONEW)

- Leading retailer of premium boats in the US

- Tiptree (TIPT)

- Holding company that primarily owns Fortegra, a leading provider of specialty insurance and warranties

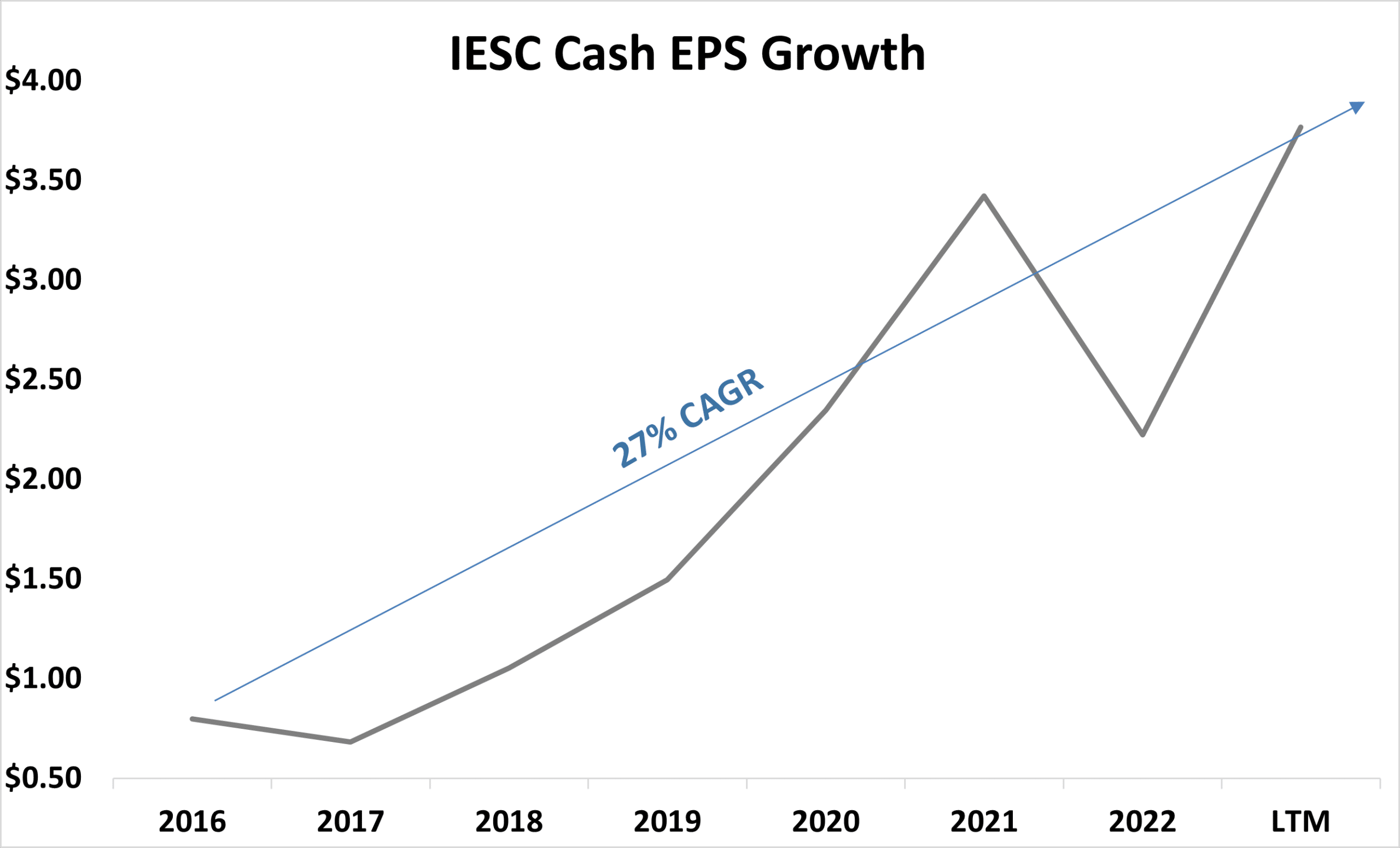

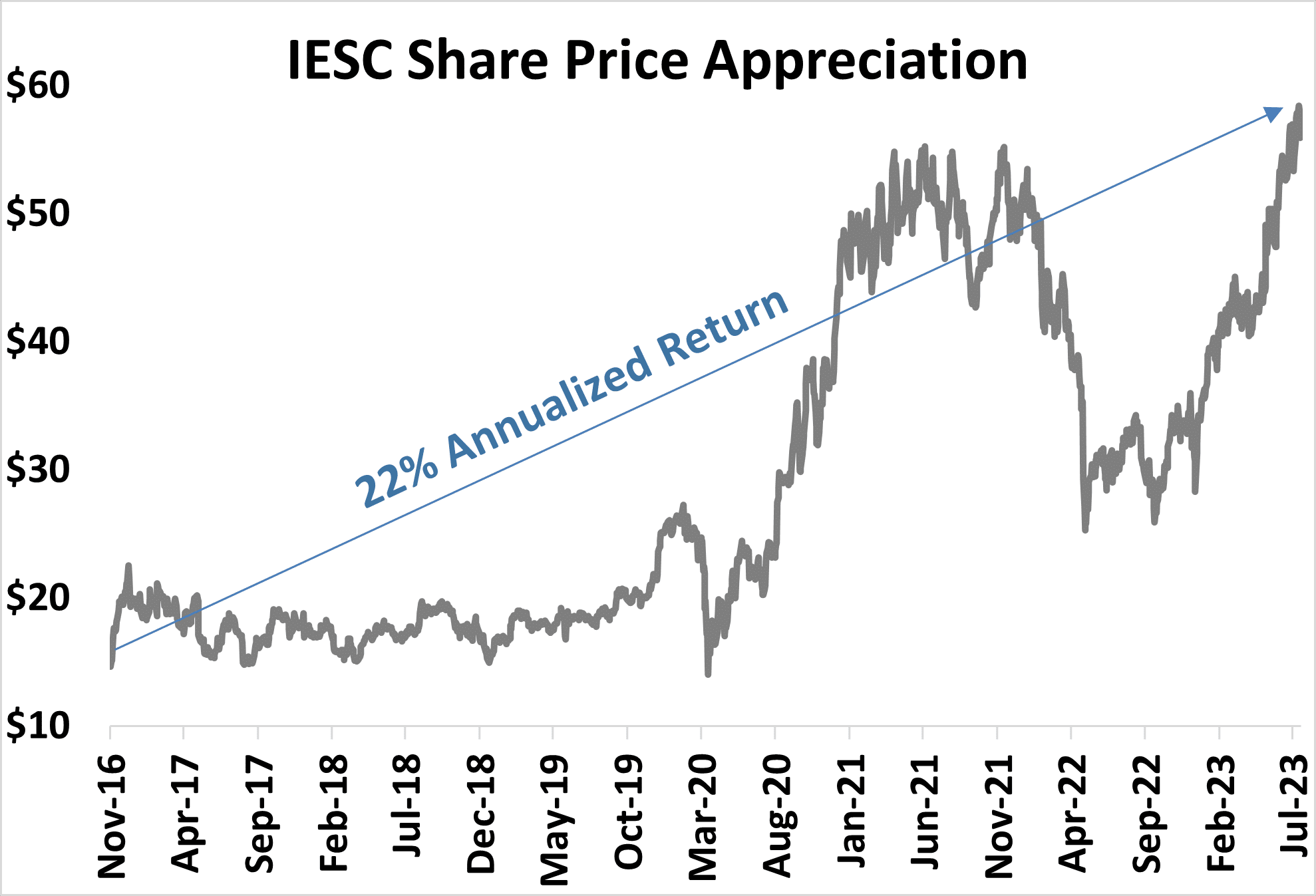

IES Holdings (IESC)

- Chairman/CEO Jeff Gendell owns 58% of IESC

- Gendell’s equity stake is worth $600mm+, dwarfing his $825K salary

- Executive compensation primarily tied to rolling 3-year cumulative earnings

- Since Gendell named Chairman in Nov ’16, IESC deployed ~$150mm into accretive acquisitions and ~$60mm into opportunistic share repurchases

- As a result, IESC generated a 25%+ EPS CAGR and 20%+ annualized shareholder return since 2016

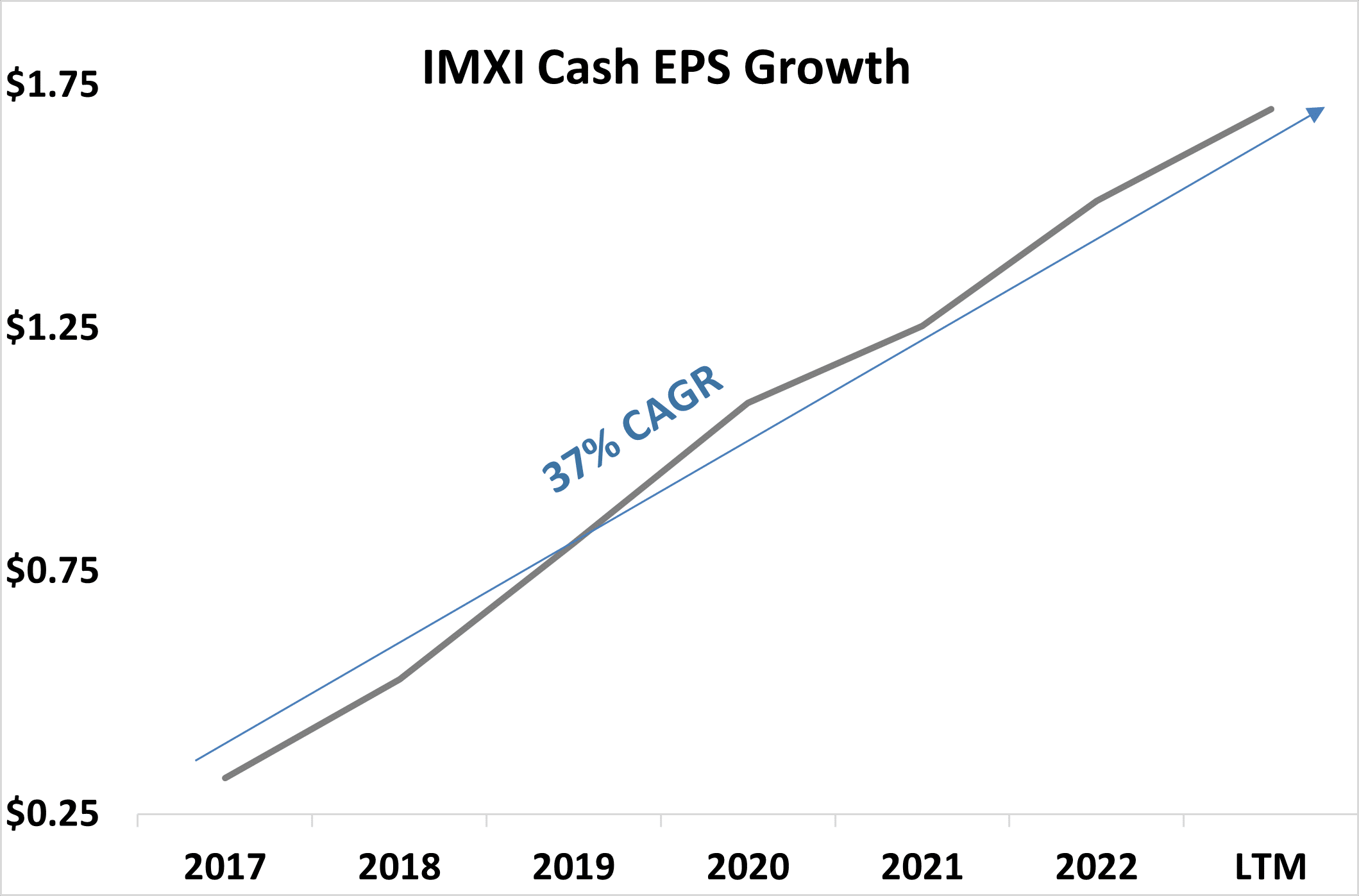

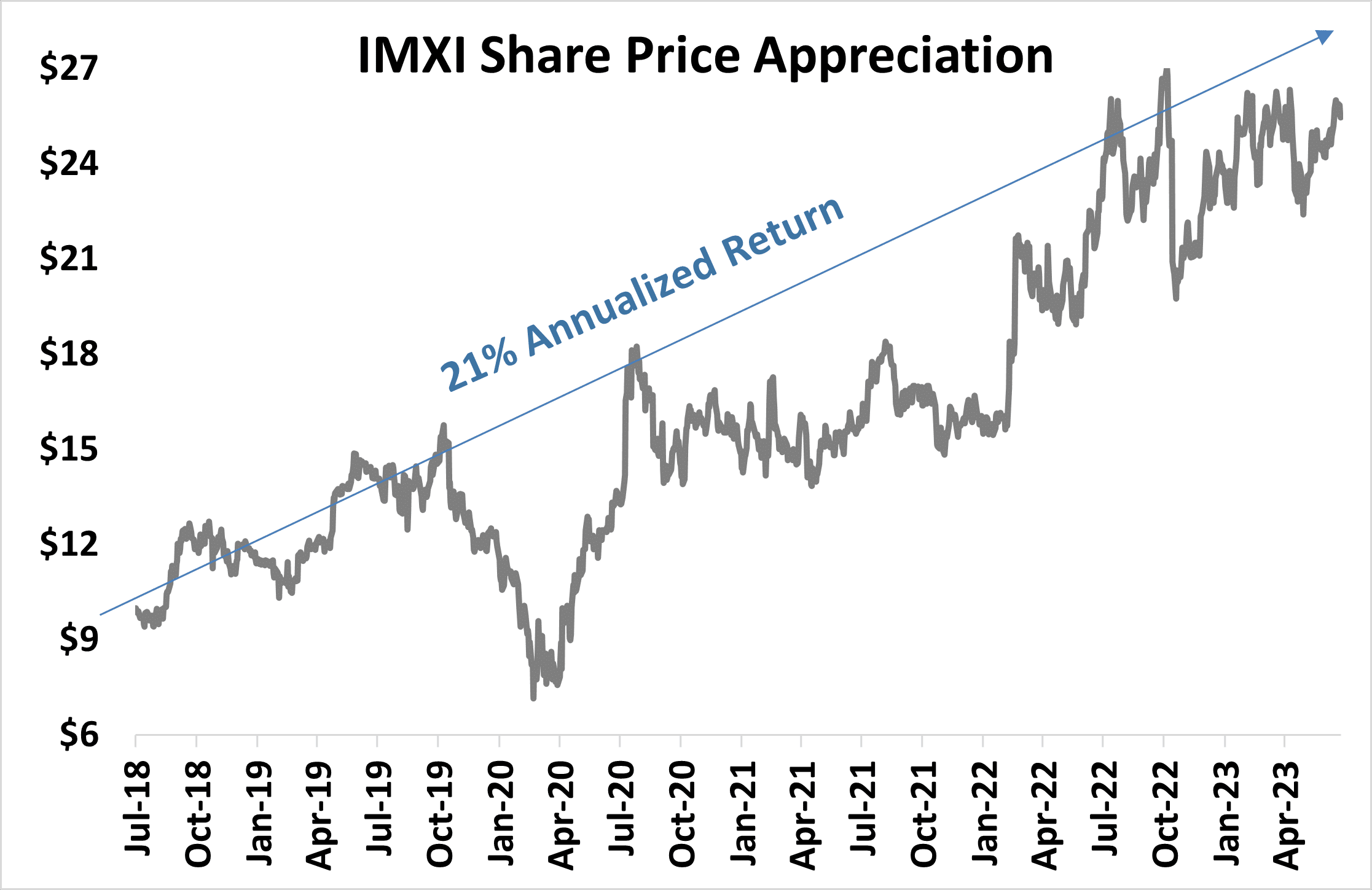

Intermex (IMXI)

- Tenured CEO Bob Lisy owns ~3% of IMXI

- Lisy’s equity stake is worth $25mm+ or ~25x his annual salary

- Most of his compensation (80%+ in 2022) is variable and linked to profit growth

- Since Lisy and the Board approved a buyback in 3Q21, IXMI already repurchased $67mm or ~8% of shares outstanding

- Due to Lisy’s thoughtful leadership and a superior business model, IMXI generated a 35%+ EPS CAGR since 2017 and 20%+ annualized shareholder return since its 2018 IPO

One Water Marine (ONEW)

- Founder/CEO Austin Singleton owns ~10% of ONEW

- Singleton’s equity stake is worth $50mm+ or 70x+ his annual salary

- His long-time COO (Anthony Aisquith) owns ~4% of ONEW

- Most of their compensation (80%+ in 2022) is variable and linked to profit growth

- Since 2016, they have deployed $386mm into attractive acquisitions

- In turn, ONEW generated a 60%+ EPS CAGR since 2017 and ~30% annualized shareholder return since its 2020 IPO

Tiptree (TIPT)

- Founder/Executive Chairman Michael Barnes owns 27% of TIPT

- Barnes’ equity stake is worth $140mm+ or 140x+ his annual salary

- Most of his compensation is tied to TIPT’s share price rising materially

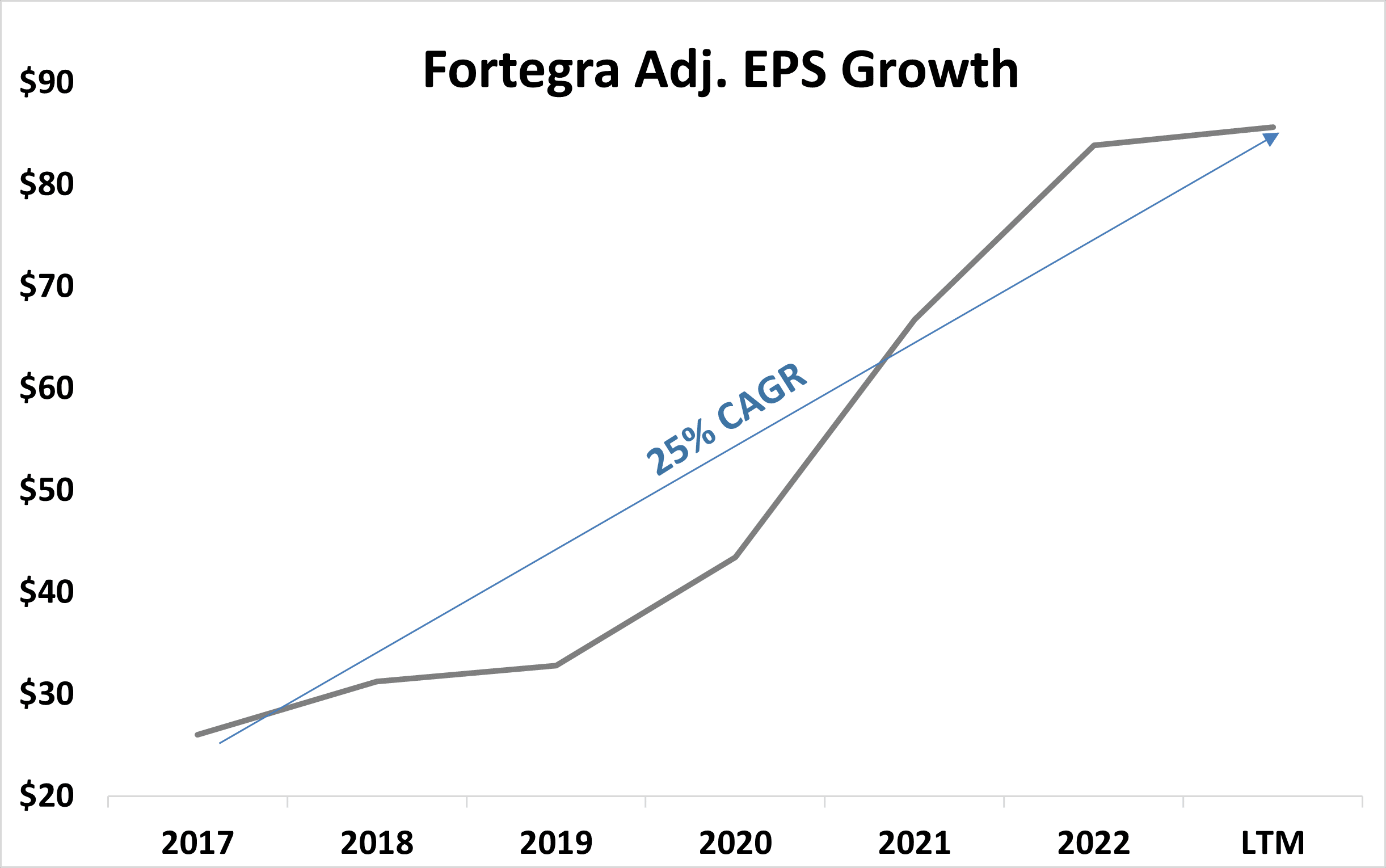

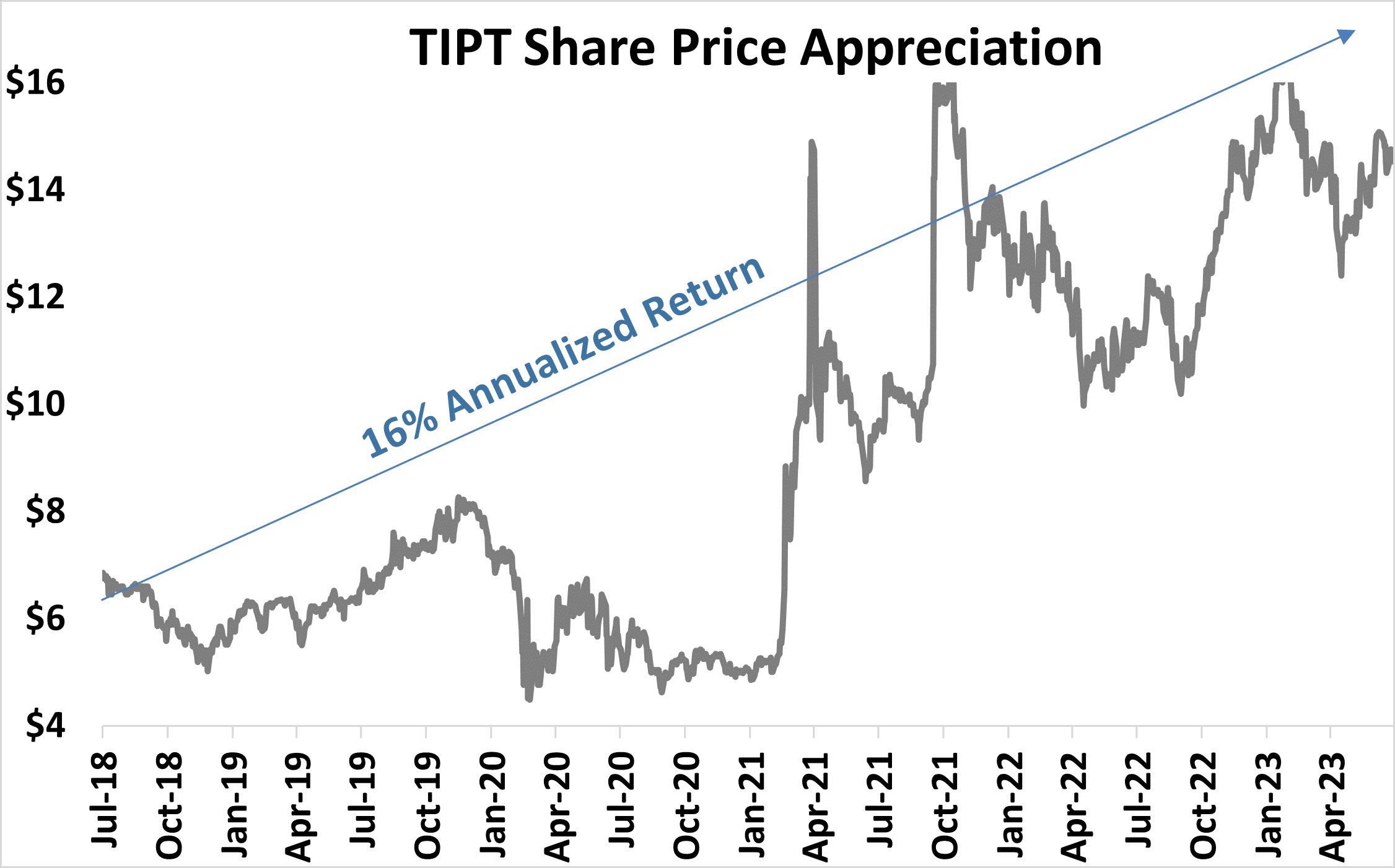

- Since 2017, TIPT’s primary asset (Fortegra) produced a 25% adjusted earnings CAGR

- Fortegra’s high growth and Barnes capital allocation led to TIPT generating an annualized shareholder return of 15%+ over the past five years

This information is provided on a confidential basis and for informational purposes only. This material may not be reproduced, displayed, modified, or distributed without the express prior written consent of Breach Inlet Capital Management, LLC (“BICM”). This information is intended solely for the receipt. This presentation has been prepared, in part, based on information reported or provided by Tiptree or other third-party sources. BICM has not independently verified such information and cannot guarantee the accuracy of all data contained herein.

This information is not complete and is only current as of the date hereof and may be superseded by subsequent market events or for other reasons. This information is not investment advice and is not a recommendation to purchase or sell any specific security. All opinions herein are those BICM. BICM does not make any representations or warranties as to the accuracy or completeness of the information including that obtained from third parties or which is provided in third-party sites linked in this presentation.

This information does not constitute an offer or solicitation to buy or sell an interest in any private funds (a “Fund”) managed by BICM or any other security. Interests in a Fund can only be made pursuant to a private placement memorandum and associated documents.

This presentation contains forward-looking statements that include statements, express or implied, regarding current expectations, estimates, projections, opinions, and beliefs of BICM, as well as assumptions on which those statements are based. Words such as “believes,” “expects,” “endeavors,” “anticipates,” “intends,” “plans,” “estimates,” “projects,” “assumes,” “potential,” “should,” and “objective,” and variations of such words and similar words, also identify forward-looking statements. Such statements are forward-looking in nature and involve a number of known and unknown risks, uncertainties and other factors, including those described in this presentation, and accordingly, actual results may differ materially, and no assurance can be given that the security presented will achieve the results discussed herein.

Recipients are cautioned not to place undue reliance on any forward-looking statements or examples included in this presentation, and BICM assumes no obligation to update any statements as a result of new information, subsequent events, or any other circumstances. Such statements speak only as of the date that they were originally made.