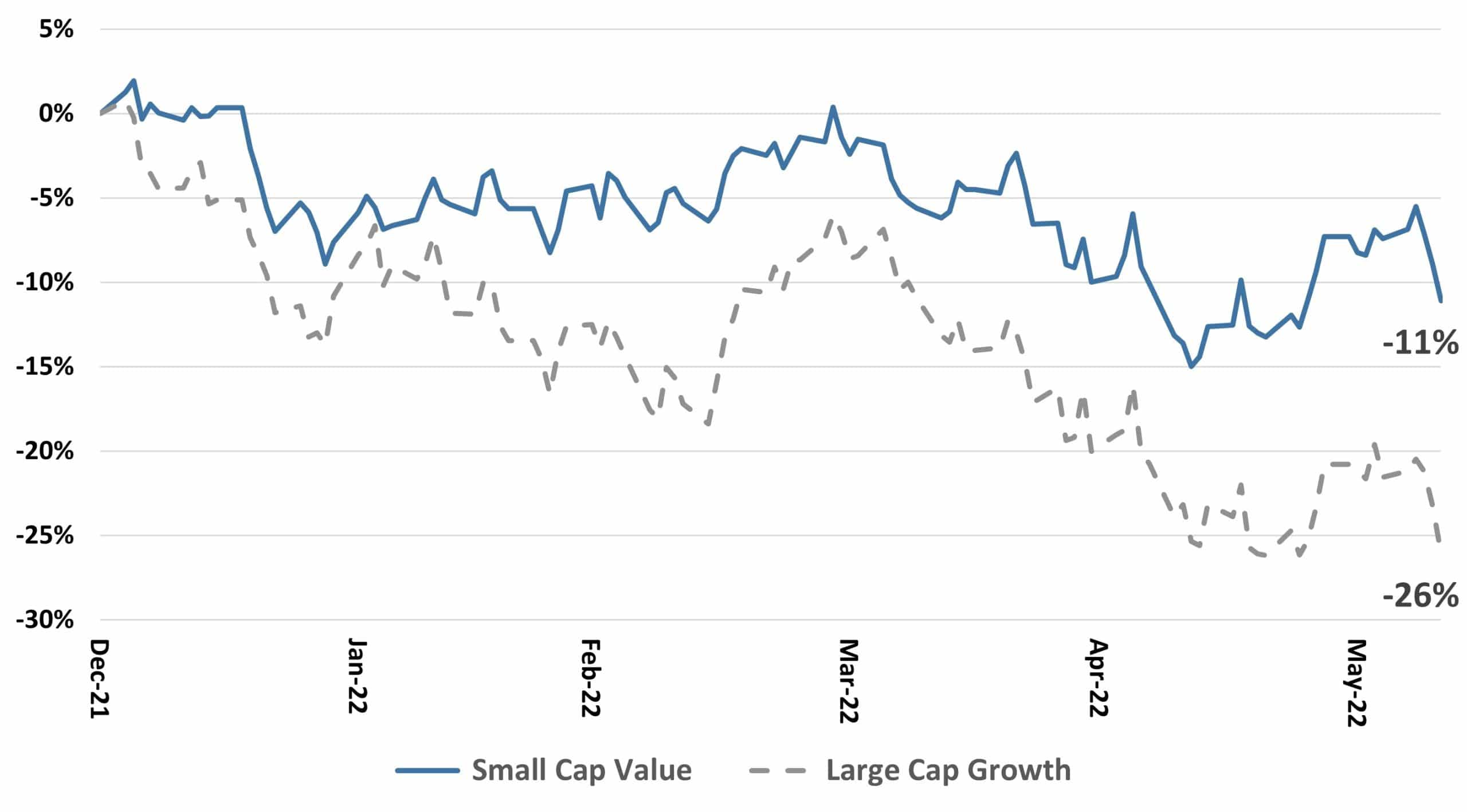

- After years of vast underperformance, Small Cap Value stocks have returned -11% compared to -26% for Large Cap Growth stocks YTD.

- History and valuations suggest we are in the early innings to capture this opportunity and can be telling as to what investor sentiment will look like going forward.

- We believe small cap value strategies are well-positioned to provide investors an opportunity to compound capital in this next cycle. The graphs below tell the story for Small Cap Value.

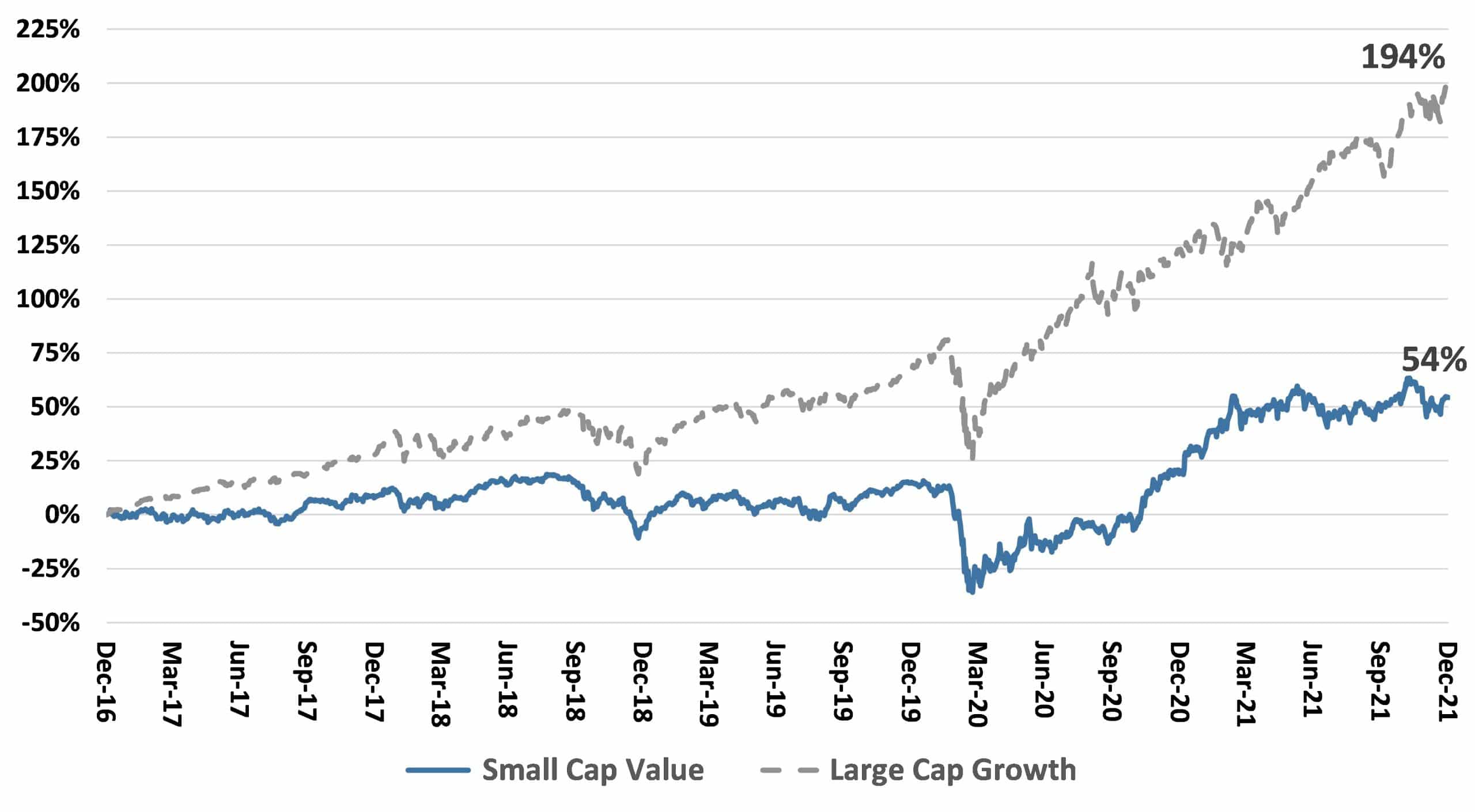

A Difficult 5 Years for Small Cap Value (2017-2021)

But Small Cap Value Has Outperformed YTD ’22

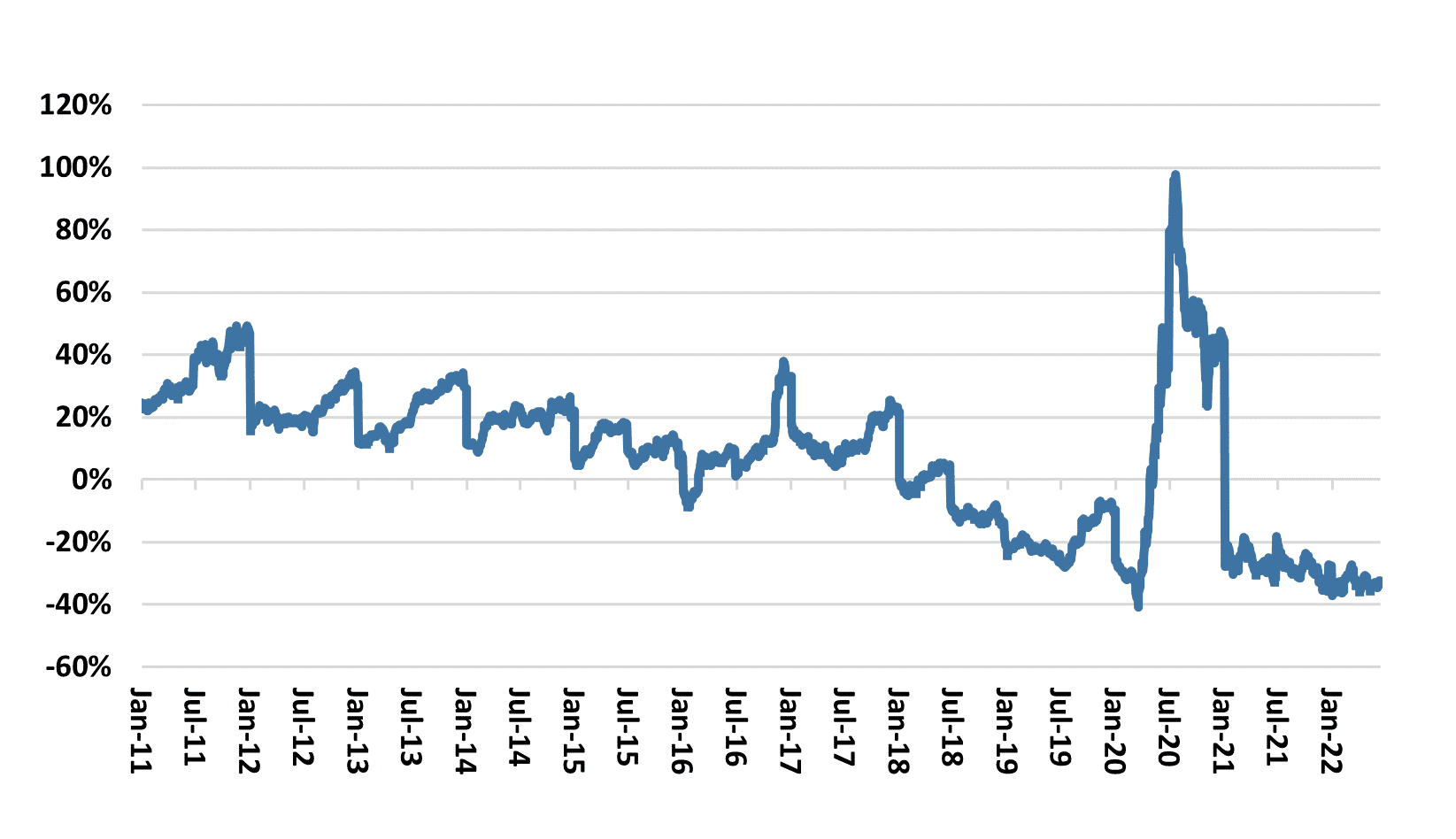

Small Cap Value Fwd P/E 32% Discount vs. S&P 500 Growth

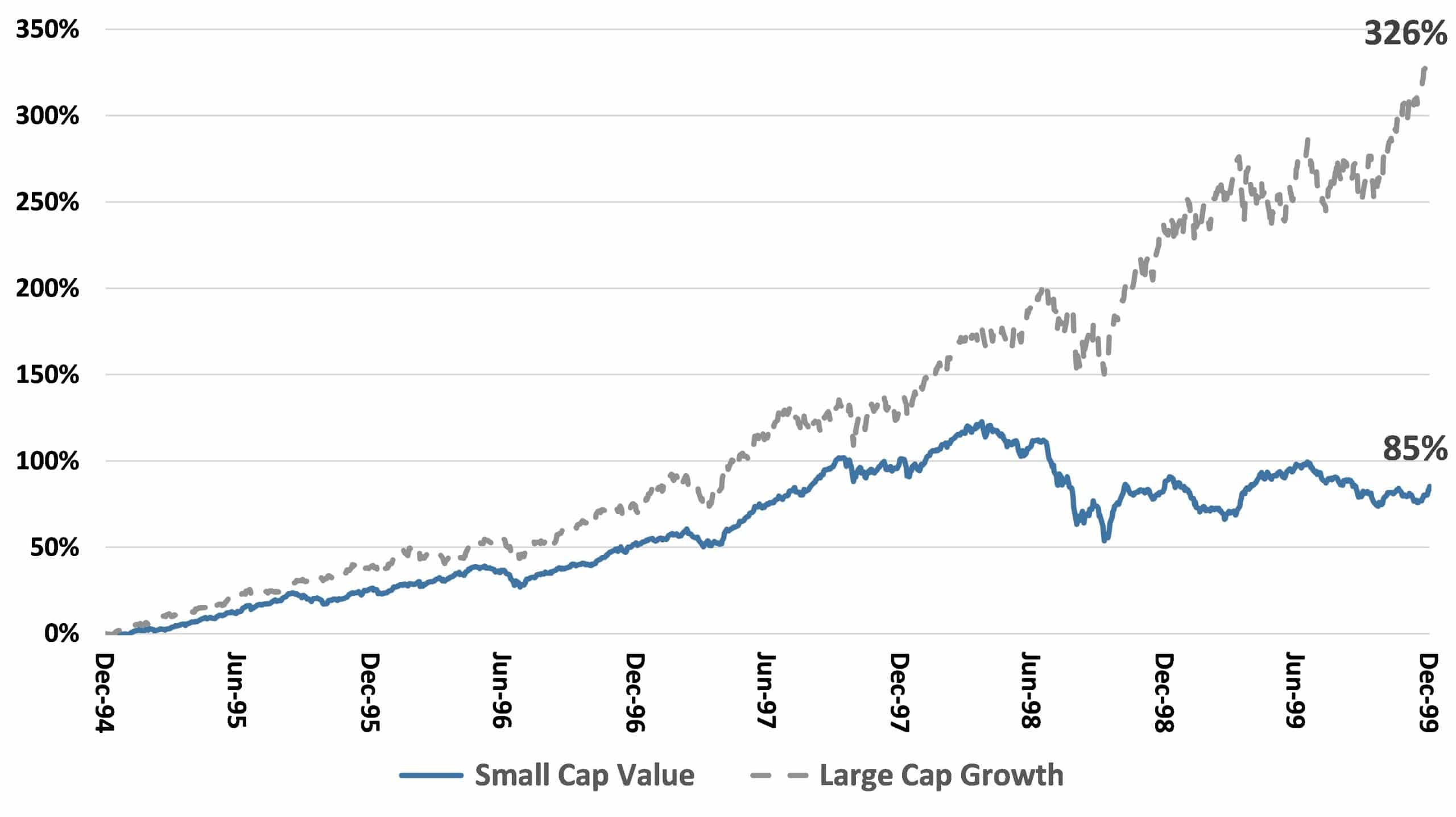

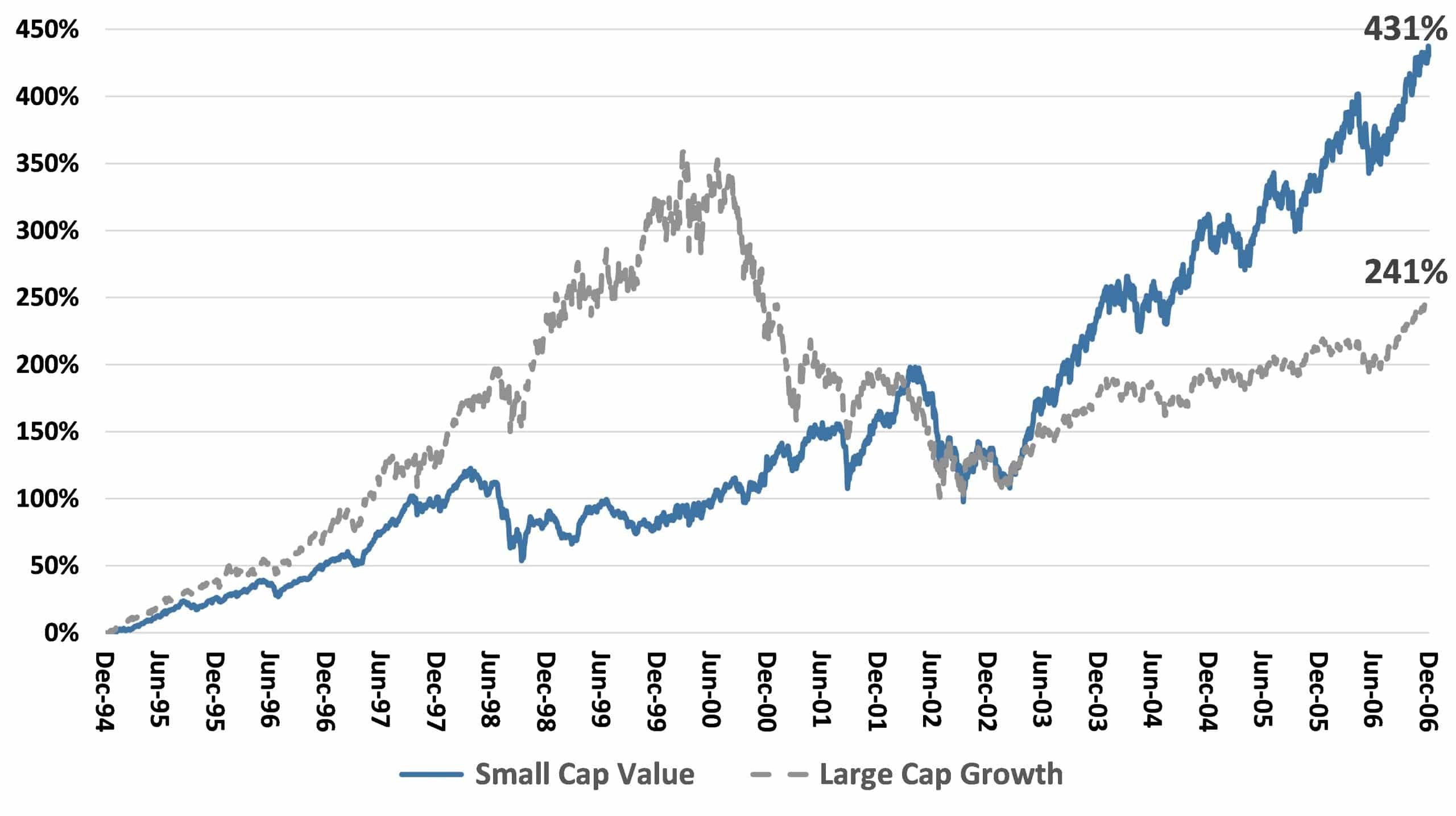

We’ve Seen This Before…Small Cap Value

Underperformed ’95-’99

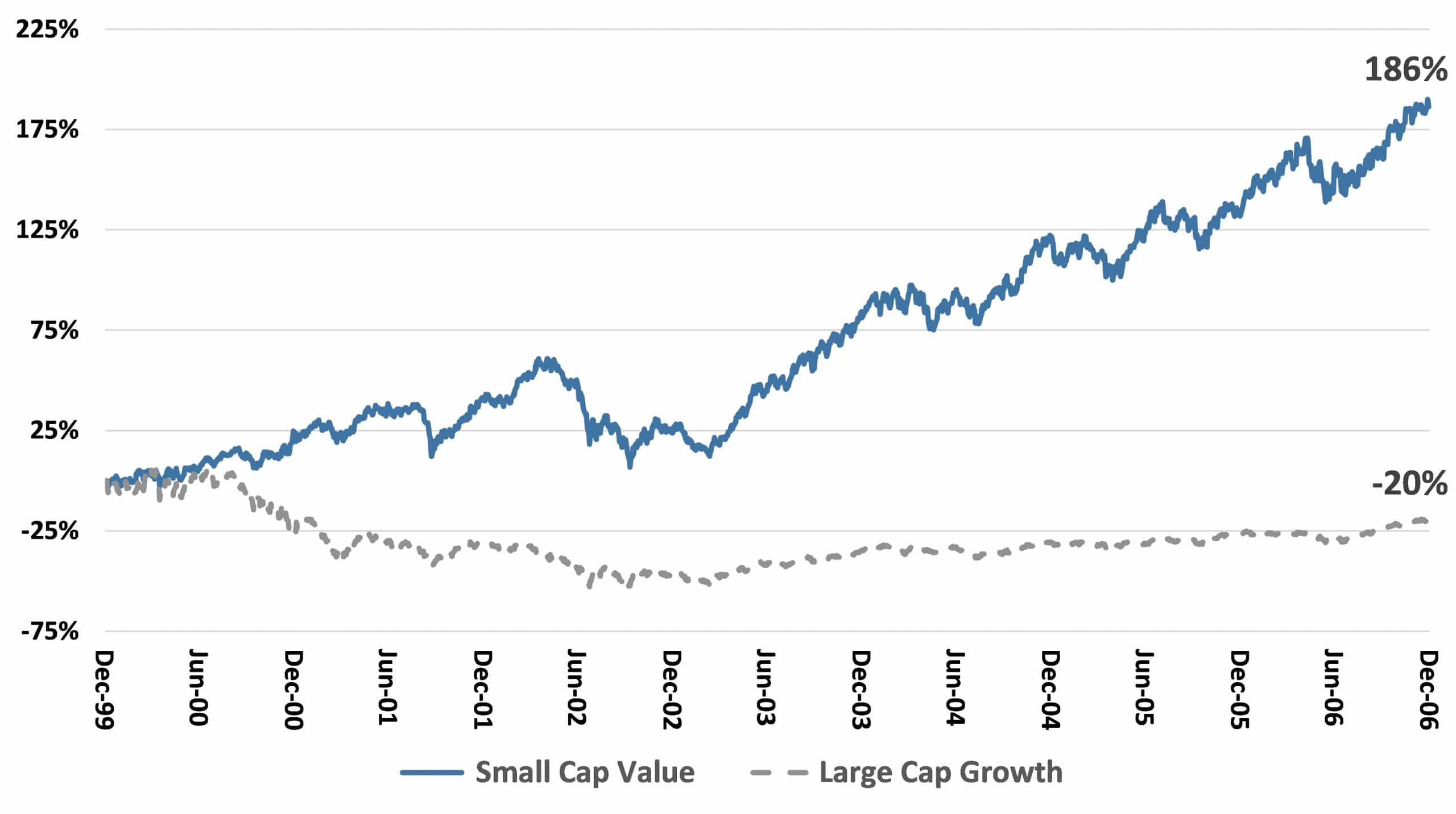

But Then Small Cap Value Outperformed ’00-’06 (7 Years!)

Ultimately, Small Cap Value Outperformed Over ’95-’06

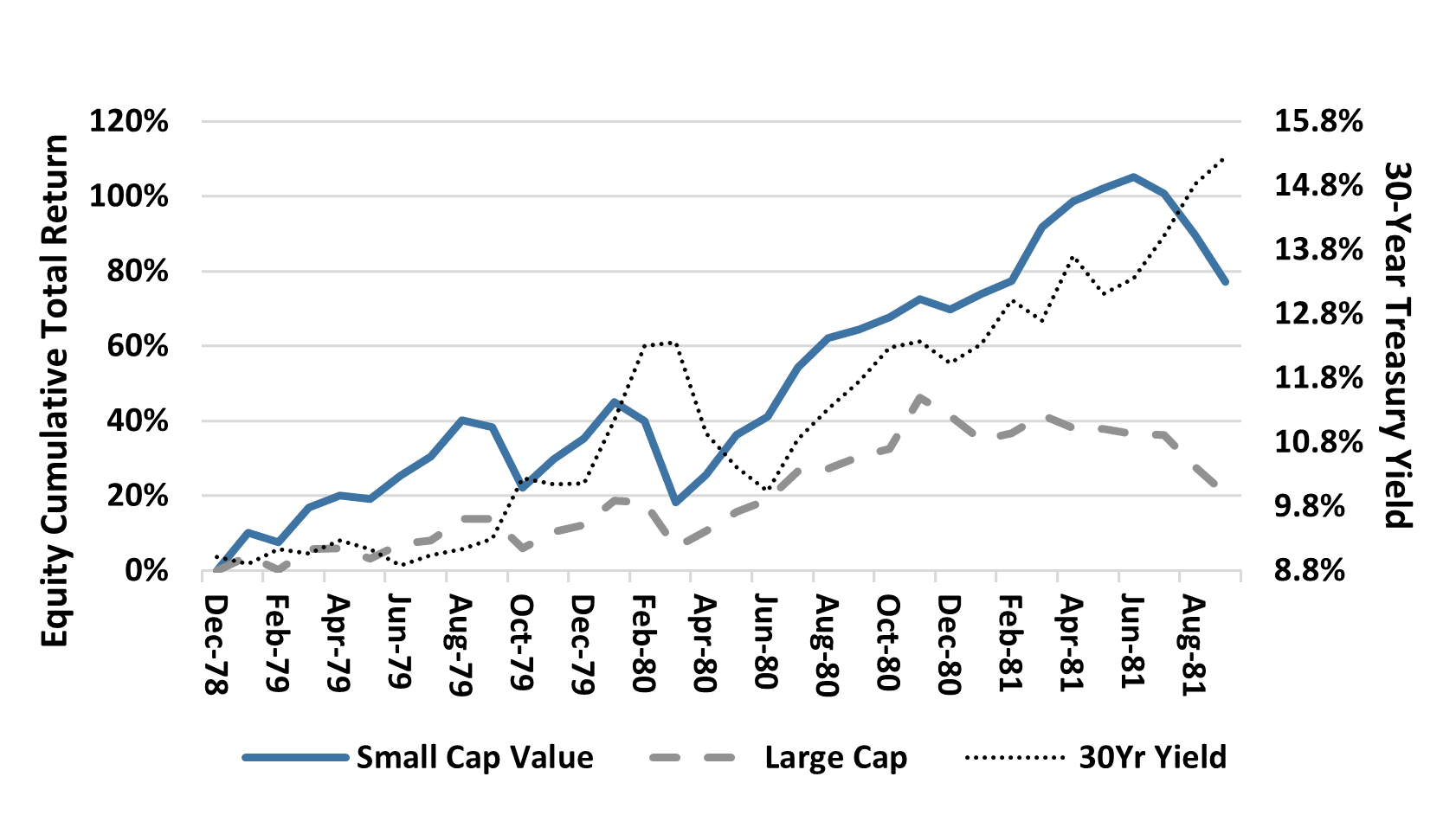

Rising Rates Are Historically a Relative Tailwind for Small Cap Value

This information is provided on a confidential basis and for informational purposes only. This material may not be reproduced, displayed, modified, or distributed without the express prior written consent of Breach Inlet Capital Management, LLC (“BICM”). This information is intended solely for the receipt. This presentation has been prepared, in part, based on information reported or provided by Tiptree or other third-party sources. BICM has not independently verified such information and cannot guarantee the accuracy of all data contained herein.

This information is not complete and is only current as of the date hereof and may be superseded by subsequent market events or for other reasons. This information is not investment advice and is not a recommendation to purchase or sell any specific security. All opinions herein are those BICM. BICM does not make any representations or warranties as to the accuracy or completeness of the information including that obtained from third parties or which is provided in third-party sites linked in this presentation.

This information does not constitute an offer or solicitation to buy or sell an interest in any private funds (a “Fund”) managed by BICM or any other security. Interests in a Fund can only be made pursuant to a private placement memorandum and associated documents.

This presentation contains forward-looking statements that include statements, express or implied, regarding current expectations, estimates, projections, opinions, and beliefs of BICM, as well as assumptions on which those statements are based. Words such as “believes,” “expects,” “endeavors,” “anticipates,” “intends,” “plans,” “estimates,” “projects,” “assumes,” “potential,” “should,” and “objective,” and variations of such words and similar words, also identify forward-looking statements. Such statements are forward-looking in nature and involve a number of known and unknown risks, uncertainties and other factors, including those described in this presentation, and accordingly, actual results may differ materially, and no assurance can be given that the security presented will achieve the results discussed herein.

Recipients are cautioned not to place undue reliance on any forward-looking statements or examples included in this presentation, and BICM assumes no obligation to update any statements as a result of new information, subsequent events, or any other circumstances. Such statements speak only as of the date that they were originally made.

There are inherent limitations regarding hypothetical or estimated information. There can be no assurance that such values can be realized or that actual results will not differ materially from those presented. Actual returns to investors will be reduced by expenses such as performance fees. There is a significant risk that pro forma financials may never be realized if the assumptions are incorrect, incomplete, or other intervening factors which are not contemplated in the pro forma assumptions

[1] Small Cap Value Index represents data taken from the Russell 2000 Value Index returns ending June 10, 2022. The Large Cap Growth Stock returns represent data from the S&P Growth Indices.