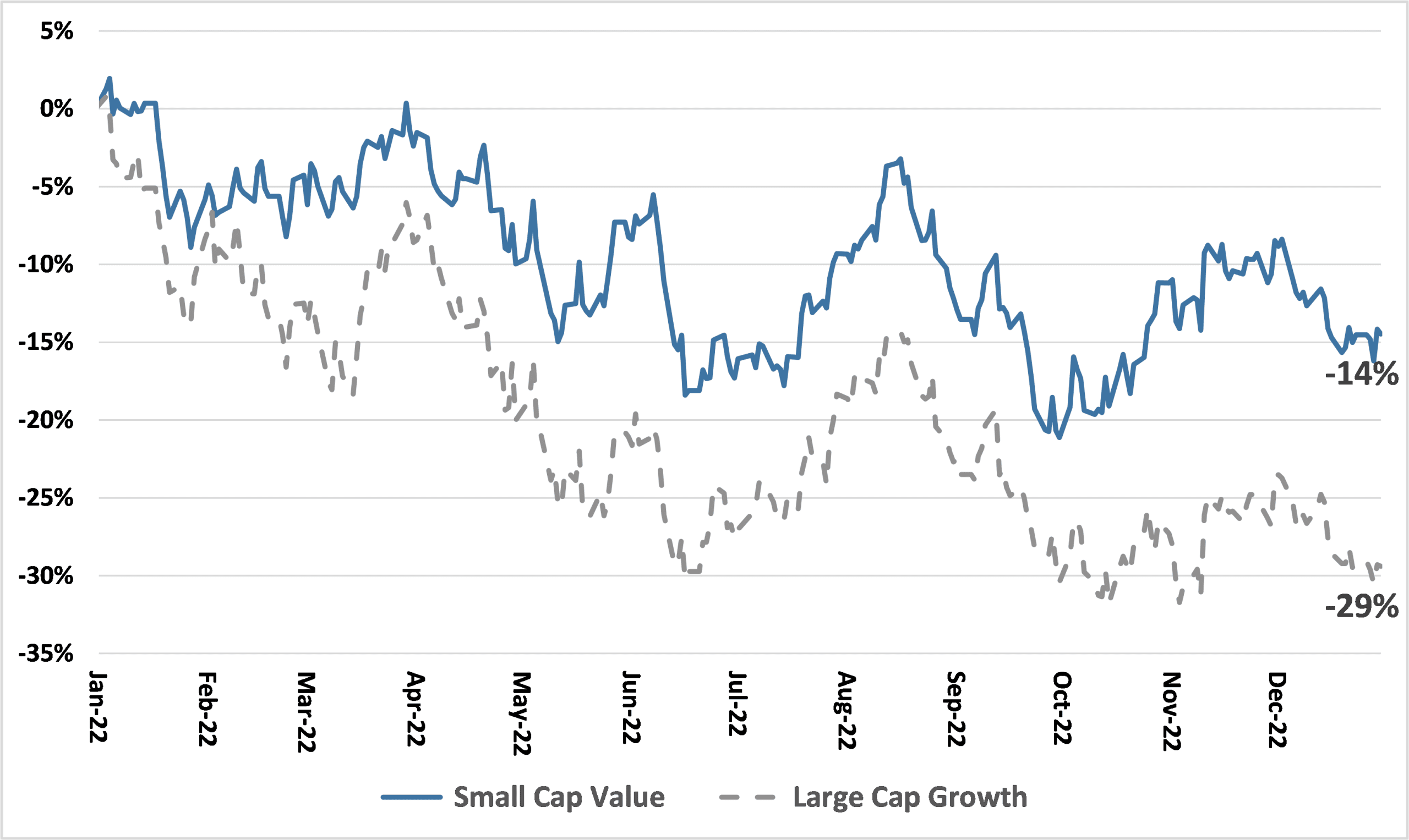

We have stated this before, but we truly believe that now is an opportune time to be invested in Small Cap Value companies. While 2022 had its fair share of market turmoil, Small Cap Value finally started to outperform Large Cap Growth stocks (Figure 1). We believe 2022 marks only the beginning of Small Cap Value outperformance for the reasons below.

Figure 1

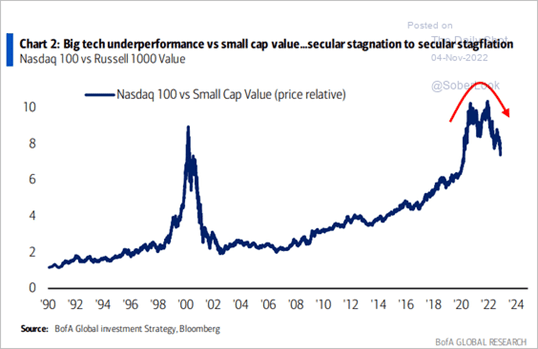

First, history indicates that Small Cap Value’s rebound could last years as Mega Cap technology stocks (that dominate the Large Cap Growth indices) could have far to fall. Figure 2 below plots the relative performance of the largest technology stocks (Nasdaq 100) versus Small Cap Value (Russell 1000). After large tech valuations peaked in late 2021, Small Cap Value began to outperform Large Cap Growth. We believe the trend will continue as higher interest rates have created a hurdle for technology stock valuations.

Figure 2

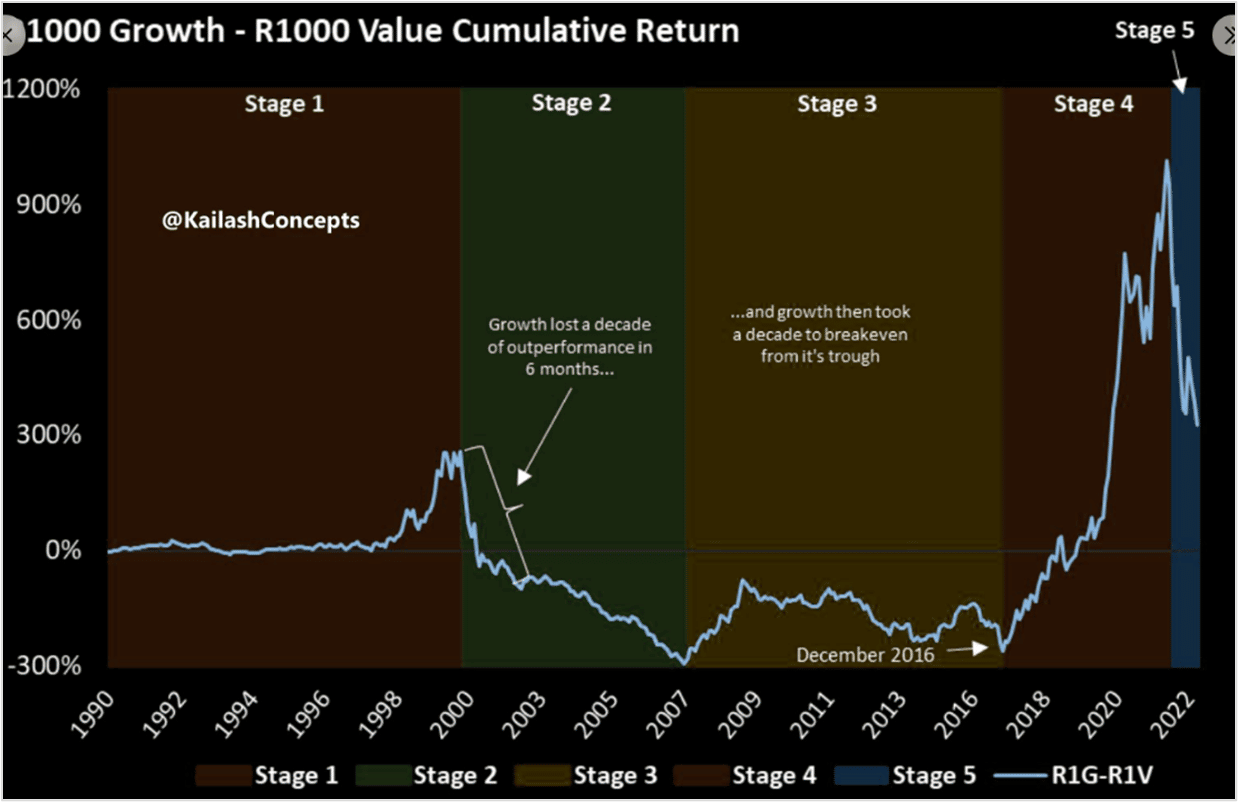

Said differently, we believe Small Cap Value stocks are poised for their time in the sun after a long, cold winter of underperformance relative to growth stocks (Figure 3). Note that when the last growth bubble burst in 2000, growth stocks lost a decade of outperformance in only six months. Then, growth stocks took another decade to sustainably rise from their underperformance trough.

Figure 3

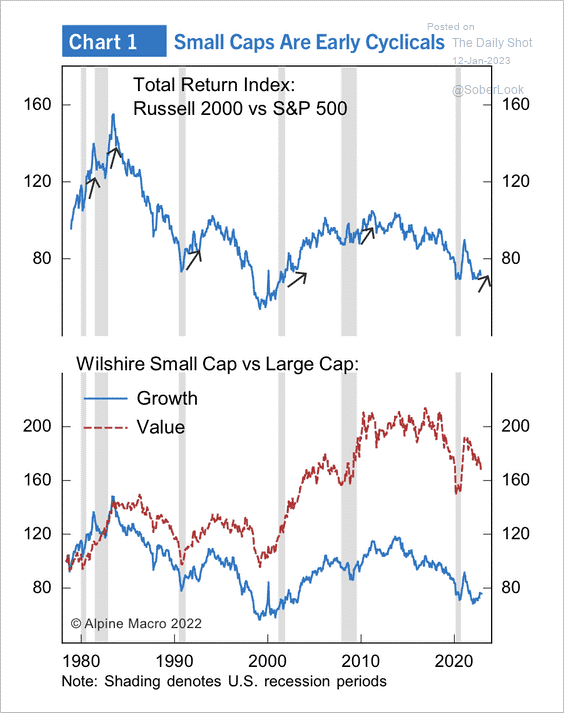

Second, Small Cap Value historically outperformed in the early stages of an economic recovery. It remains to be seen if and how long a looming economic contraction may last, but small companies typically lead the way out. Figure 4 illustrates how Small Caps outperform following recessionary periods (gray bars).

Figure 4

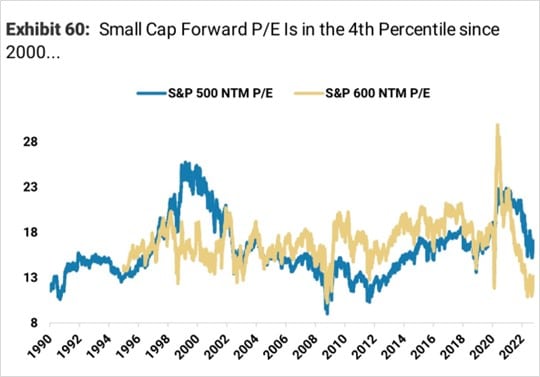

In addition, Small Caps valuation relative to Large Caps are nearly as attractive as they have been in 30+ years (Figure 5). Often, low valuations translate to future outperformance.

Figure 5

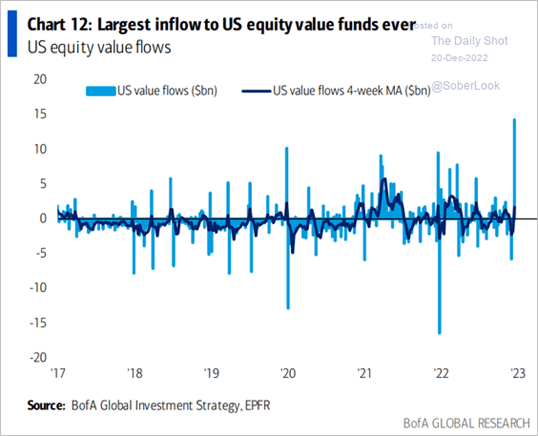

Finally, Value stocks saw record inflows as 2022 came to a close (Figure 6). This renewed interest could portend future outperformance.

Figure 6

This information is provided on a confidential basis and for informational purposes only. This material may not be reproduced, displayed, modified, or distributed without the express prior written consent of Breach Inlet Capital Management, LLC (“BICM”). This information is intended solely for the receipt.

This information is not complete and is only current as of the date hereof and may be superseded by subsequent market events or for other reasons. This information is not investment advice and is not a recommendation to purchase or sell any specific security. All opinions herein are those of Chris Colvin, principal of BICM. Mr. Colvin and BICM do not make any representations or warranties as to the accuracy or completeness of the information including that obtained from third parties or which is provided in third-party sites linked in this presentation.

This information does not constitute an offer or solicitation to buy or sell an interest in any private funds (a “Fund”) managed by BICM or any other security. Interests in a Fund can only be made pursuant to a private placement memorandum and associated documents.

This presentation contains forward-looking statements that include statements, express or implied, regarding current expectations, estimates, projections, opinions, and beliefs of BICM, as well as assumptions on which those statements are based. Words such as “believes,” “expects,” “endeavors,” “anticipates,” “intends,” “plans,” “estimates,” “projects,” “assumes,” “potential,” “should,” and “objective,” and variations of such words and similar words, also identify forward-looking statements. Such statements are forward-looking in nature and involve a number of known and unknown risks, uncertainties and other factors, including those described in this presentation, and accordingly, actual results may differ materially, and no assurance can be given that the security presented will achieve the results discussed herein.

Recipients are cautioned not to place undue reliance on any forward-looking statements or examples included in this presentation, and BICM assumes no obligation to update any statements as a result of new information, subsequent events, or any other circumstances. Such statements speak only as of the date that they were originally made.

There are inherent limitations regarding hypothetical or estimated information. There can be no assurance that such values can be realized or that actual results will not differ materially from those presented. Actual returns to investors will be reduced by expenses such as performance fees. There is a significant risk that pro forma financials may never be realized if the assumptions are incorrect, incomplete, or other intervening factors which are not contemplated in the pro forma assumptions.

[1] Small Cap Value Index represents data taken from the Russell 2000 Value Index returns ending December 31, 2023. The Large Cap Growth Stock returns represent data from the S&P Growth Indices.